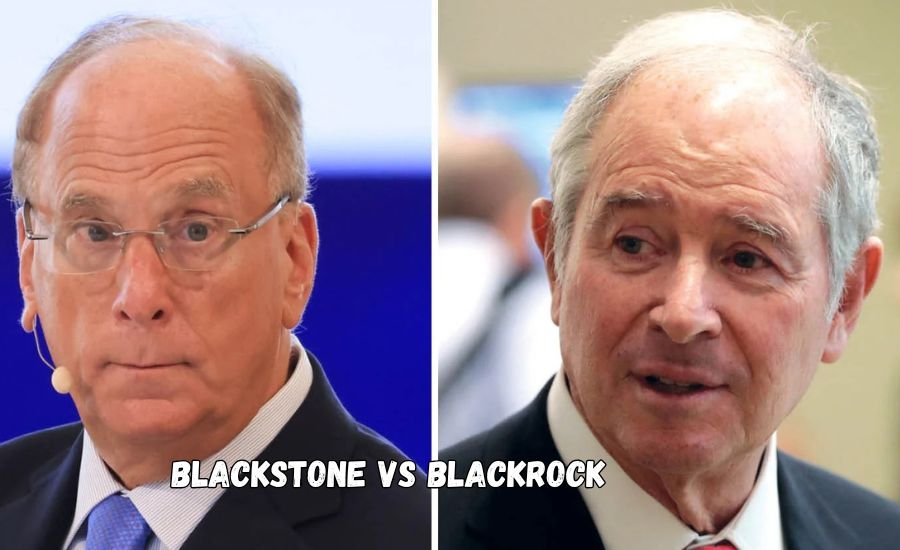

Blackstone vs BlackRock: Key Differences, Investment Strategies, and Market Impact

In the world of finance, few names resonate as strongly as Blackstone and BlackRock. These two global giants have redefined investment management, setting standards in asset management, private equity, and financial technology. While both companies are often compared due to their sheer influence, they differ greatly in business approach, investment focus, and market impact. This article explores Blackstone and BlackRock’s histories, business models, investment strategies, and societal impact, equipping readers to understand the essential differences and make informed investment decisions.

Company Backgrounds

Blackstone: A Pioneer in Alternative Investments

Founded in 1985 by Stephen Schwarzman and Peter Peterson, Blackstone quickly emerged as a powerhouse in alternative investments, focusing on private equity, real estate, hedge funds, and credit. Initially a boutique investment bank, Blackstone pivoted to alternative asset management, allowing it to secure high returns on unique investment types outside traditional stock and bond markets. Today, Blackstone manages over $1 trillion in assets, with real estate and private equity at its core, reflecting a business model anchored in alternative strategies.

BlackRock: Leading Asset Management through Technology

BlackRock, established in 1988 by Larry Fink and others, took a different path. Initially focused on risk management and fixed-income investments, BlackRock has evolved into the world’s largest asset manager, with assets exceeding $9 trillion. While traditional asset management remains central, BlackRock has set itself apart by prioritizing technology, particularly with its Aladdin platform, a revolutionary risk and portfolio management tool. Additionally, BlackRock’s iShares ETFs have democratized investing, making it easier for individuals worldwide to access diverse financial markets.

Business Models and Core Differences

Blackstone’s Alternative Investment Focus

Blackstone’s business model emphasizes alternative investments, providing clients access to private equity, real estate, credit, and hedge fund strategies. Its alternative asset focus helps clients diversify portfolios and potentially achieve higher returns, though often with increased risk. Blackstone’s private equity approach involves buying companies, restructuring them, and selling them for profit, while its real estate investments cover both residential and commercial properties worldwide.

BlackRock’s Diversified Asset Management Approach

In contrast, BlackRock operates a diversified asset management model, encompassing traditional and alternative assets. Known for its extensive range of ETFs, particularly through the iShares brand, BlackRock enables broad market participation, allowing retail and institutional investors to invest in low-cost funds across sectors and geographies. BlackRock’s focus on public market assets and technology positions it as a leader in accessible, data-driven investing, contrasting Blackstone’s focus on private investments.

Investment Strategies and Products

Blackstone’s Investment Strategies

Blackstone’s strategy revolves around generating alpha through active investment in alternative assets. Its private equity arm identifies companies with high growth potential or turnaround opportunities, while the real estate division invests in properties that can appreciate significantly. The hedge fund and credit strategies add diversification, catering to investors seeking returns outside traditional equity and fixed-income markets.

BlackRock’s Technology-Driven Approach

BlackRock’s products include mutual funds, ETFs, and private equity, but its core strategy emphasizes passive management and data-driven insights. Its Aladdin platform has transformed risk management in asset management, providing advanced data analytics to enhance investment decisions. BlackRock’s ETFs, particularly iShares, appeal to investors focused on lower fees and broad market exposure, making it a leader in passive investing.

Market Impact and Economic Influence

Blackstone’s Role in Private Markets

Blackstone’s influence in private markets is substantial. As one of the world’s largest private equity firms, its investment decisions impact a broad range of industries, from hospitality to healthcare. Blackstone’s real estate deals have reshaped entire neighborhoods and cities, demonstrating the firm’s economic clout. Through its alternative investments, Blackstone not only pursues profit but also drives significant economic activity in various sectors.

BlackRock’s Influence in Public Markets

BlackRock’s impact is most visible in public markets, with its ETFs and mutual funds held by millions of investors globally. BlackRock’s large-scale asset holdings grant it significant voting power, making it a key player in corporate governance. Its commitment to sustainable investing, especially with its ESG-focused funds, pushes public companies to prioritize environmental and social factors. This approach positions BlackRock as a catalyst for change in global finance, emphasizing corporate responsibility alongside profits.

Leadership and Corporate Culture

Blackstone’s Stephen Schwarzman: Vision and Transformation

Stephen Schwarzman, Blackstone’s co-founder and CEO, has been instrumental in transforming Blackstone into an alternative investment behemoth. Known for his disciplined approach to investment and risk, Schwarzman’s leadership style emphasizes long-term value creation. Blackstone’s corporate culture reflects this vision, focusing on disciplined investment and strategic growth.

BlackRock’s Larry Fink: The Voice of Sustainable Investing

Larry Fink, BlackRock’s CEO, advocates for a balance between profitability and responsibility, particularly in the realm of sustainable investing. Fink’s annual letters to CEOs underscore BlackRock’s commitment to environmental and social governance (ESG), encouraging companies to adopt sustainable practices. BlackRock’s culture promotes transparency and accountability, values deeply embedded in its business model.

Performance and Growth Metrics

Blackstone’s Performance in Alternative Assets

With its focus on high-return, high-risk assets, Blackstone has consistently delivered robust returns, outperforming traditional asset classes. In recent years, Blackstone’s assets under management have surged, particularly in private equity and real estate. Blackstone’s revenue and profitability reflect its adeptness in capturing alpha, making it a popular choice for investors seeking above-market returns.

BlackRock’s Broad-Based Growth in Asset Management

BlackRock’s growth has been marked by steady increases in assets under management, particularly within its iShares ETFs. As of the latest data, BlackRock’s assets exceed $9 trillion, a testament to its diversified portfolio and appeal among both retail and institutional investors. BlackRock’s AUM growth showcases its resilience and ability to adapt to market changes, driven by its focus on technology and sustainable investing.

Read More: FINBUSINES

Social Responsibility and ESG Commitments

Blackstone’s ESG Approach

Blackstone is committed to improving its ESG (Environmental, Social, and Governance) impact, particularly in real estate and private equity. By implementing sustainable practices in its real estate investments, such as energy-efficient buildings, Blackstone aims to contribute positively to the environment. However, Blackstone’s approach to ESG has been scrutinized due to its private equity focus, as some argue that private investments lack the transparency of public companies.

BlackRock’s ESG Leadership

BlackRock has positioned itself as a global leader in ESG investing. Under Larry Fink’s guidance, the firm emphasizes sustainable investing, with many funds dedicated to ESG criteria. BlackRock’s shareholder activism extends its influence by promoting sustainability and social responsibility in public companies. This commitment aligns with investor demand for companies that prioritize long-term societal benefits alongside financial returns.

Risks and Criticisms

Blackstone’s Exposure to Market Cycles

Blackstone’s reliance on alternative assets subjects it to market volatility, particularly during economic downturns. Critics argue that Blackstone’s private equity investments may lack liquidity, posing challenges during financial crises. The company addresses this through diversified strategies but remains exposed to cyclical risks inherent in private investments.

BlackRock’s Regulatory and ESG Challenges

BlackRock faces regulatory scrutiny, especially in its role as a shareholder in numerous public companies. Critics argue that BlackRock’s significant influence may lead to conflicts of interest, particularly in matters of corporate governance. Additionally, BlackRock’s ESG initiatives have faced skepticism, with some questioning the sincerity and impact of its sustainable investment approach.

Conclusion

In comparing Blackstone and BlackRock, each company’s unique strengths and focus areas come to light. Blackstone’s expertise in alternative investments offers high returns and portfolio diversification, appealing to investors willing to embrace higher risk. BlackRock, with its emphasis on accessible, technology-driven asset management, caters to a broad range of investors prioritizing cost efficiency and transparency. For investors, the choice between Blackstone and BlackRock depends on risk tolerance, investment goals, and preference for private versus public market exposure. By understanding these differences, investors can make informed decisions, choosing the firm that aligns best with their financial ambitions.

FAQs

Q: What is the main difference between Blackstone and BlackRock?

A: Blackstone focuses on alternative investments like private equity and real estate, while BlackRock is an asset management firm known for its ETFs, mutual funds, and technology-driven investing.

Q: Who are the founders of Blackstone and BlackRock?

A: Blackstone was founded by Stephen Schwarzman and Peter Peterson, while BlackRock was co-founded by Larry Fink and other partners.

Q: What type of investors typically choose Blackstone?

A: Blackstone appeals to institutional and high-net-worth investors seeking high returns from private equity, real estate, and alternative assets.

Q: Why is BlackRock known for sustainable investing?

A: BlackRock advocates for ESG (Environmental, Social, and Governance) principles, and many of its funds prioritize sustainability, appealing to investors interested in socially responsible investing.

Q: How does BlackRock’s Aladdin platform help its clients?

A: Aladdin is a technology platform that provides data analytics and risk management tools, enabling BlackRock and its clients to make more informed investment decisions.

Q: What are iShares, and how do they relate to BlackRock?

A: iShares is BlackRock’s line of ETFs, offering investors an affordable, diversified way to invest in various markets worldwide.

Q: Are Blackstone and BlackRock competitors?

A: While both are financial giants, they focus on different investment areas. Blackstone specializes in private markets, whereas BlackRock leads in public market asset management and ETFs.

Check Out the Latest Blogs Regarding: Michael-Ciminella